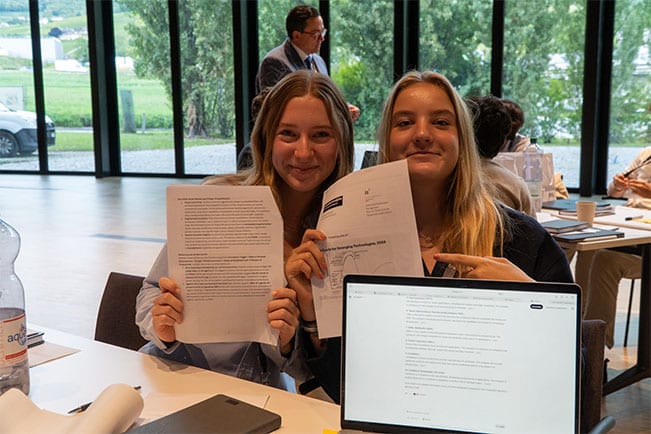

Students at Le Rosey recently had the privilege of attending an enlightening session with Professor Alex Edmans, who delivered a compelling discourse on the intersection of artificial intelligence in finance and the critical importance of data literacy. The presentation, organized as part of the school's commitment to providing cutting-edge educational experiences, challenged Roséens to develop a more discerning approach to the information they encounter daily. Professor Edmans emphasized that in an era dominated by data-driven decision making, the ability to critically evaluate information has become an essential skill for future leaders. He illustrated how even sophisticated financial models powered by AI can produce misleading results if the underlying data contains biases or methodological flaws. The session at Le Rosey explored various real-world examples where seemingly objective data led to incorrect conclusions in financial markets, investment strategies, and economic forecasting. Professor Edmans demonstrated how confirmation bias often creeps into data analysis, where analysts unconsciously seek information that supports their pre-existing beliefs while ignoring contradictory evidence. He highlighted several high-profile cases from the financial industry where this phenomenon resulted in significant losses. The discussion also covered the growing role of machine learning algorithms in financial services, from credit scoring to algorithmic trading, and the importance of understanding both the capabilities and limitations of these technologies. Students learned about the concept of 'garbage in, garbage out' – the principle that flawed input data will inevitably lead to flawed outputs, regardless of the sophistication of the analytical tools employed. This foundational understanding is particularly crucial for Le Rosey students who may pursue careers in finance, economics, or data science. The session emphasized that while AI and quantitative methods have revolutionized financial analysis, human judgment and critical thinking remain indispensable. Professor Edmans encouraged students to approach all data with healthy skepticism, asking probing questions about collection methods, sample sizes, and potential confounding variables. This mindset, he argued, is essential not only for success in finance but for navigating the complex information landscape of the modern world.

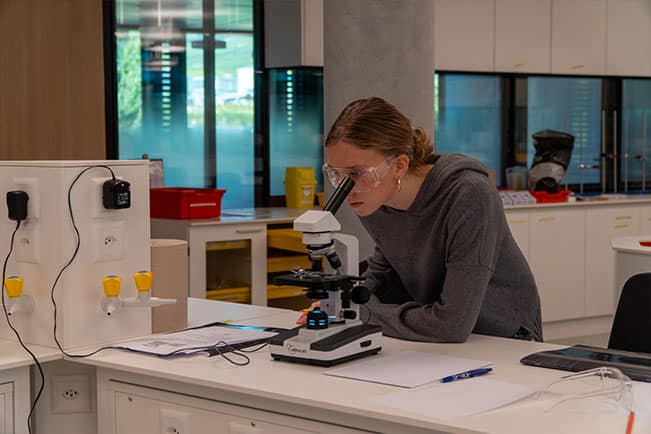

Professor Edmans delved deeper into the practical applications of AI in financial contexts while maintaining a strong focus on developing students' critical evaluation skills. He presented case studies showing how artificial intelligence is transforming various aspects of finance, including risk assessment, fraud detection, and portfolio management. However, he consistently returned to his central theme: the necessity of questioning and validating data-driven conclusions. The professor explained how statistical significance can be manipulated or misinterpreted, and how correlation is often mistaken for causation in financial analysis. He shared examples from his own research and industry experience where seemingly robust data led to incorrect investment decisions because analysts failed to consider alternative explanations or hidden variables. The session at Le Rosey particularly emphasized the ethical dimensions of AI in finance, discussing how algorithmic bias can perpetuate and even amplify existing inequalities in credit access and financial services. Professor Edmans challenged students to consider not just whether data analysis techniques are technically sound, but whether they are fair and equitable in their outcomes. He introduced the concept of 'explainable AI' in financial contexts – the importance of understanding why an algorithm makes particular recommendations rather than blindly following its outputs. This approach aligns with Le Rosey's educational philosophy of developing well-rounded, ethically-minded individuals who can navigate complex professional environments. The discussion also covered the psychological aspects of data interpretation in financial decision-making, exploring how cognitive biases affect even experienced professionals when they interact with quantitative information. Professor Edmans provided practical frameworks for identifying potential flaws in financial data and AI models, including techniques for stress-testing assumptions and validating results through multiple methods. He emphasized that in an age of increasingly sophisticated financial technology, the most valuable skill may be the ability to recognize when data or algorithms are producing misleading results. The session concluded with an interactive exercise where Le Rosey students analyzed real financial datasets, applying the critical thinking principles they had learned to identify potential pitfalls and alternative interpretations. This hands-on experience reinforced the message that technological proficiency must be paired with intellectual rigor and ethical consideration to achieve truly informed decision-making in finance and beyond.